Choosing a broker is not only a financial decision — it’s a legal and tax strategy. For Colombian tax residents, investing through a foreign broker or a local one can result in very different tax burdens, compliance obligations, and net profitability.

At Nieto Lawyers, we analyze two main scenarios investors face: investing through an international broker such as Interactive Brokers or eToro, and investing via the Colombian Global Market through platforms like Trii or Bancolombia Trading. Below, we present a comparative analysis that combines financial, legal, and tax factors you should consider before deciding where to invest.

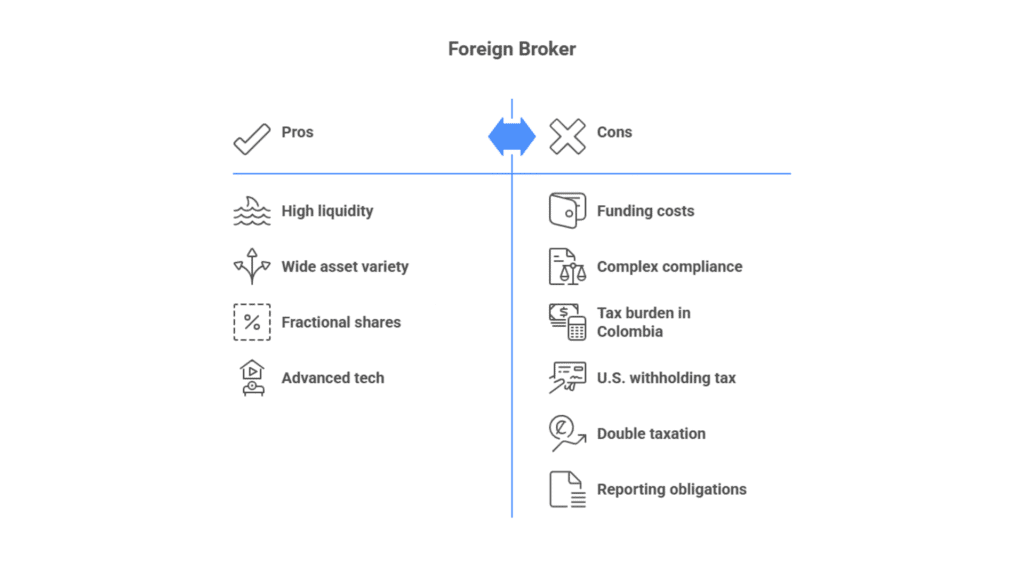

1. Scenario A – Foreign Broker (Interactive Brokers, eToro, Happy, etc.)

Advantages

- High liquidity: international markets have massive trading volumes that allow fast and efficient transactions.

- Wide variety of assets: access to equities, ETFs, bonds, derivatives, and multiple global markets.

- Fractional share purchases: investors can buy partial shares of expensive stocks such as Apple or Tesla.

- Advanced technology: trading platforms with professional-grade analytics, charts, and real-time data.

Disadvantages

- Funding costs: international wire transfers involve banking fees and foreign exchange costs.

- Complex compliance: investors must understand the broker’s jurisdiction, including exposure to the U.S. Estate Tax.

Tax burden in Colombia:

- If shares are held for more than two years, the gain is considered a capital gain under Article 300 of the Colombian Tax Code (E.T.), taxed at 15%.

- If held for less than two years, the gain is treated as ordinary income under Article 26 E.T., taxed progressively from 0% to 39%.

- U.S. withholding tax: 30% on dividends.

- Double taxation: Colombian residents may deduct foreign taxes paid, subject to the limits in Article 254 E.T.

Reporting and currency control obligations:

- Form 160 – Foreign Assets Declaration, required if assets exceed 2,000 UVT (~COP 99,598,000 for 2024).

- Foreign exchange registration before the Central Bank of Colombia (Banco de la República) when funding accounts abroad.

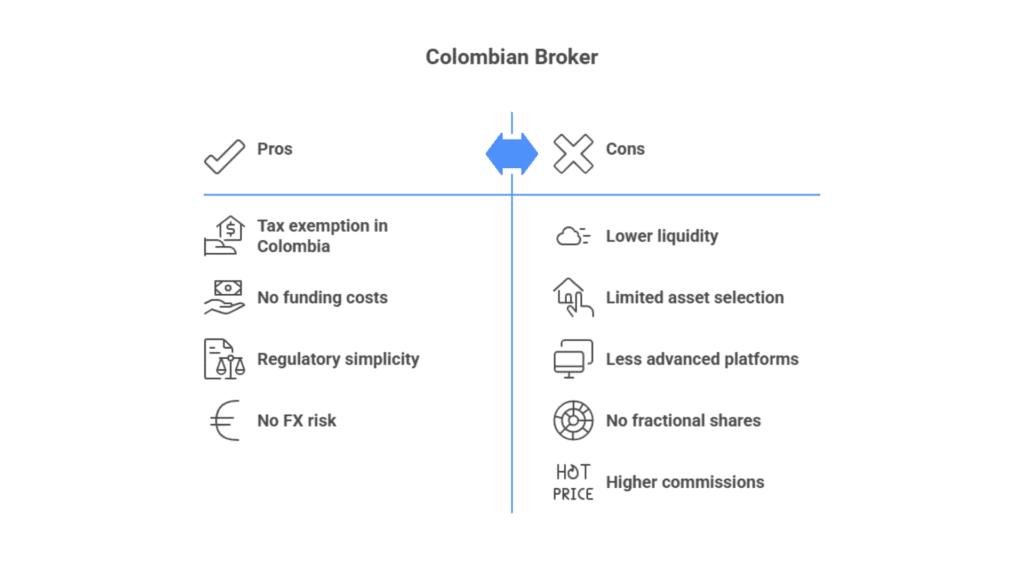

2. Scenario B – Colombian Broker (Trii, Credicorp Capital, Bancolombia Trading)

Advantages

- Tax exemption: under Article 36-1 E.T., gains from selling listed shares in the Colombian Stock Exchange are not taxable (neither as income nor as capital gain) if the investor holds less than 3% of the company’s outstanding shares.

- No funding costs: local transfers from Colombian bank accounts are free of international fees.

- Regulatory simplicity: the investor remains fully under Colombian tax and legal rules, with easy access to accountants and advisors.

- No FX risk: all investments are expressed in Colombian pesos, even those traded through the Global Market.

Disadvantages

- Lower liquidity: some assets have very low daily trading volumes.

- Limited asset selection: roughly 50 available assets (stocks and ETFs).

- Less advanced platforms: still developing compared to international standards.

- No fractional shares: investors must buy whole units.

- Higher commissions: typically between USD 4–5 per trade, versus less than USD 1 abroad.

3. Overall Comparison

| Concept | Foreign Broker | Colombian Broker |

|---|---|---|

| Liquidity | Very high | Limited |

| Asset variety | Global (U.S., EU, Asia) | Around 50 instruments |

| Fractional shares | Available | Not available |

| Funding cost | High (international transfer) | None |

| Tax on sale | 15% capital gain (Art. 300 E.T.) or up to 39% ordinary income (Art. 26 E.T.) | Exempt (Art. 36-1 E.T.) |

| Dividend withholding | 30% (U.S.) | 30% (via local intermediary) |

| FX risk | High | None |

| Reporting obligations | Form 160, FX registration, estate tax | Local DIAN reporting |

| Commissions | 1 USD | 4–5 USD per trade |

| Tax benefit | Partial foreign tax credit (Art. 254 E.T.) | Full exemption (Art. 36-1 E.T.) |

4. Key Legal and Tax Considerations

- Holding period: if you operate through a foreign broker and hold your shares for more than two years, any profit from their sale will be treated as a capital gain under Article 300 of the Colombian Tax Code (E.T.) and taxed at 15%. If held for less than two years, it’s ordinary income under Article 26 E.T. and taxed between 0%–39%.

- Shareholding threshold: exemption under Art. 36-1 E.T. applies only if holding ≤3% of shares.

- Double taxation: foreign taxes paid can be credited in Colombia (Art. 254 E.T.) up to the Colombian tax due on the same income.

- Estate tax exposure: U.S. assets may be subject to Estate Tax (18%–40%) plus 15% inheritance tax in Colombia, creating potential losses exceeding 50%.

- Compliance duties: failure to file Form 160 or register FX operations can trigger penalties under Articles 641 and 643 E.T.

5. Practical Recommendations for Colombian Investors

- Evaluate not only expected returns but total tax efficiency.

- Seek professional guidance before opening foreign accounts to ensure compliance with Colombian tax and currency regulations.

- Diversify strategically while maintaining proper legal structuring.

- Consider succession and tax planning if holding significant foreign assets.

- If trading actively, analyze whether fees, currency risk, and tax rates erode your net profit.

Conclusion

Investing abroad offers diversification and liquidity, but also increases your tax exposure and reporting obligations. Conversely, investing through the Colombian Global Market provides key tax exemptions and operational simplicity, though with fewer options. The optimal choice depends on your risk profile, investment horizon, and personal tax situation.

Optimize your tax structure before investing abroad

Schedule a consultation with Nieto Lawyers’ Foreign Investment and Tax Planning Team. We help you structure your investments safely, legally, and tax-efficiently.

WhatsApp

WhatsApp