Operating a company in Colombia offers significant opportunities, but it also involves corporate governance and compliance regulations that foreign investors, board members, and senior executives must clearly understand.

A recent administrative action initiated by the Superintendencia de Sociedades (Colombia’s corporate regulator) has reignited an essential question for directors and officers:Does the corporate structure truly protect personal assets when governance and compliance failures occur?

This article explains what happened, what the law actually says, and why this issue matters for foreign shareholders, multinational groups, and board members overseeing Colombian subsidiaries.

A recent regulatory action in Colombia: why it matters

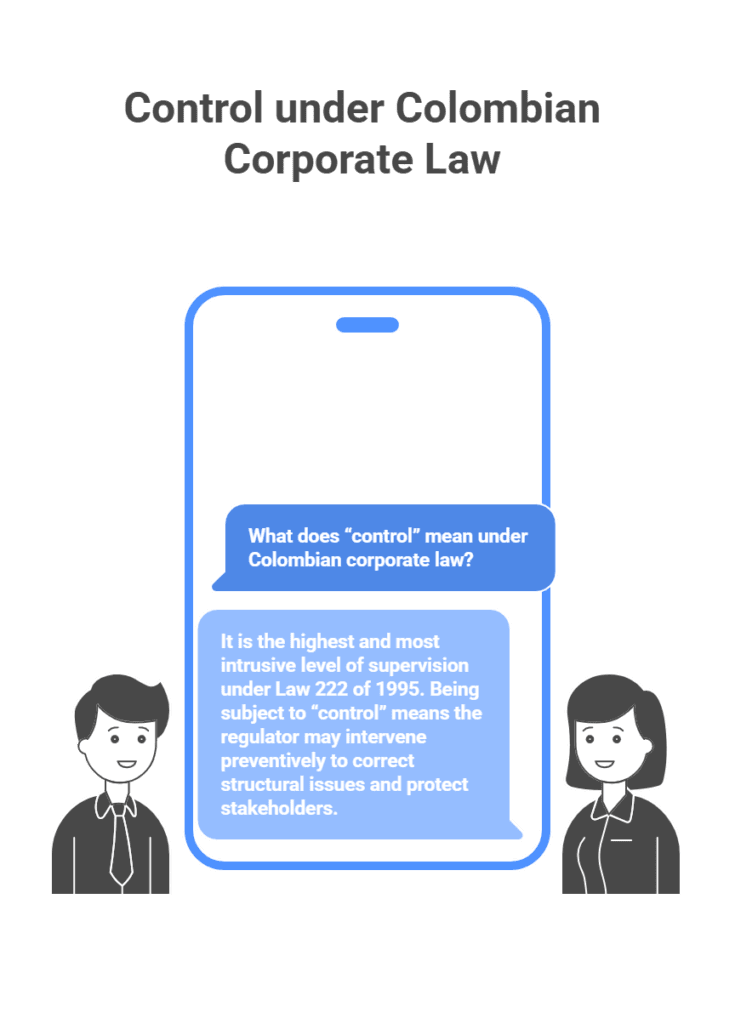

In November 2025, the Superintendencia de Sociedades (Colombia’s corporate regulator)announced the opening of an administrative proceeding aimed at placing a Colombian company under the highest level of corporate supervision known as “control.”

The authority cited accounting, financial, and legal concerns identified during its preliminary assessment.

Importantly, this action: i) Does not imply liquidation ii) Does not mean government takeover iiii) Does not automatically impose sanctions

However, it does signal serious governance and compliance concerns and activates enhanced regulatory powers. For international investors and directors, the relevance lies not in the specific company, but in what the case illustrates about personal liability exposure in Colombia.

Key legal clarifications

- The regulator does not manage the company

- Directors and officers remain in office

- Shareholders retain their ownership rights

- The measure is corrective, not punitive by default

However, the company becomes subject to enhanced scrutiny, and management decisions are closely examined.

Why directors and officers should pay close attention

Colombian law does not provide absolute protection to directors and officers simply because a company is a separate legal entity.

When authorities identify serious accounting irregularitie, breach of statutory duties, mismanagement and or lack of diligence or loyalty, the law allows the regulator to assess personal responsibility, always subject to due process.

Directors’ and officers’ duties under Colombian law

Directors, legal representatives, and board members are legally required to act with good faith, loyalty and the diligence of a prudent businessperson.

These duties apply regardless of whether the company is local or part of an international group.

If authorities determine that these duties were breached, personal consequences may follow, depending on the facts and the outcome of the administrative process.

Why this is particularly relevant for foreign investors and boards

For multinational groups and foreign shareholders, this issue often surfaces during: i) due diligence processes, ii) compliance audits, iii) restructuring or turnaround scenarios, iv) M&A transactions and v) regulatory stress situations.

International boards sometimes assume that local managers absorb most regulatory risk, or corporate structures fully shield individual exposure

In Colombia, that assumption can be dangerous if governance is weak or compliance controls are insufficient.

Frequently Asked Questions (Q&A)

Can directors really be personally liable in Colombia?

Yes. Colombian law allows personal liability when directors breach their legal or fiduciary duties, subject to due process.

Does being under “control” automatically lead to fines or sanctions?

No. “Control” is a preventive and corrective measure. Sanctions are only possible if violations are proven through a formal process.

Are shareholders personally liable as well?

Generally, shareholders’ liability is limited. However, administrators (directors and officers) have distinct personal duties.

Does this apply to simplified stock companies (S.A.S.)?

Yes. S.A.S. entities are subject to corporate supervision and administrators’ duties, unless specific statutory exceptions apply.

Can risks be mitigated once an administrative process has started?

In many cases, yes. Early legal strategy, corrective measures, and proper documentation can significantly reduce exposure.

Is this risk relevant even if the company is financially viable?

Yes. Governance and compliance failures—not only insolvency—can trigger scrutiny and liability analysis.

Key lessons for boards and management teams

This regulatory action reinforces several practical lessons:

1, Corporate compliance is not a formality

2. Financial transparency and documentation are critical

3.Board oversight must be active, not symbolic

4. Directors should understand local law exposure, even in subsidiaries

5. Preventive legal advice is far less costly than reactive defense

How Nieto & Nieto Lawyers assists international clients in Colombia

At Nieto & Nieto Lawyers, we advise foreign investors, multinational groups, Colombian subsidiaries, board members and senior executives on directors’ and officers’ liability, corporate governance frameworks, regulatory risk prevention, compliance audits, interactions with the Superintendence of Companies.

Our approach focuses on anticipation, risk mapping, and practical solutions, not crisis management alone.

Are you a director, officer, or investor involved in a Colombian company?

A confidential governance and liability assessment can help identify risks before they become personal exposure.

Contact our corporate law team corporativo@nietolawyers.com for a tailored review

WhatsApp

WhatsApp

Final takeaway

The recent action by Colombia’s corporate regulator is not merely a legal headline.

It is a clear reminder that corporate structures do not automatically shield individuals when governance and compliance fall short.

For international investors and board members, understanding this framework is not optional. It is part of responsible corporate oversight in Colombia. Rather than discouraging investment, Colombia’s corporate oversight framework provides predictability and legal certainty for investors who prioritize strong governance and compliance