A World of Competing Jurisdictions

In today’s landscape of international trade, taxation, and customs compliance, companies are not just seeking to pay fewer taxes—they aim to build sustainable and legitimate structures.

Global reforms driven by the OECD (BEPS 2.0) and the European Union (ATAD III – Unshell Directive) have raised the bar for economic substance and transparency.

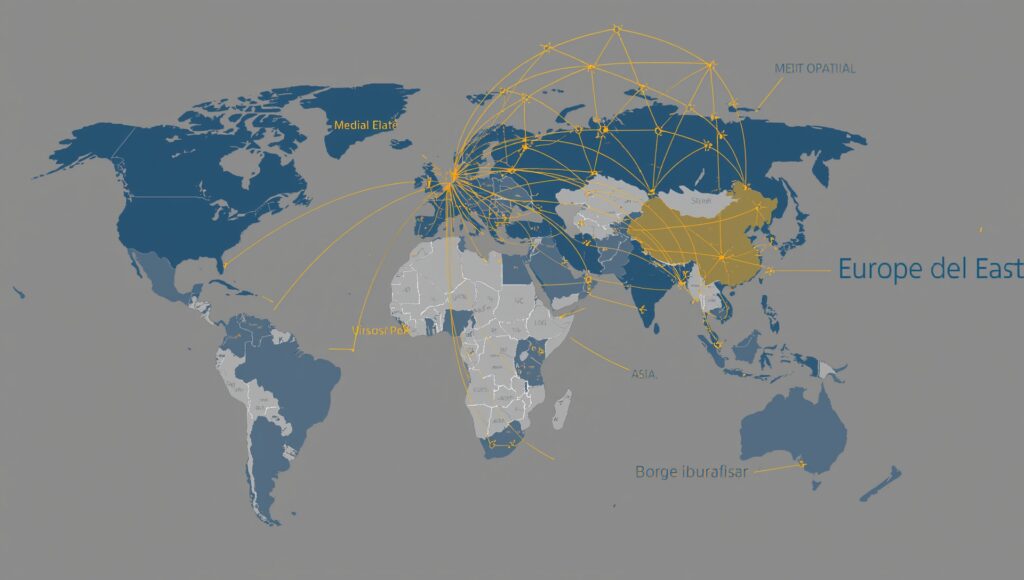

As a result, the Baltic jurisdictions (Estonia, Latvia, and Lithuania) and Dubai have emerged as alternative hubs for digital, technology, and cross-border trade companies looking for efficiency without sacrificing legal credibility.

The Baltic Region: A Fiscal Ecosystem Within the European Union

The three Baltic republics share a modern, digitalized, and EU-aligned fiscal vision, though each presents its own particular strengths and characteristics.

Legal–Tax Criterion (2025)

| Criterion | Estonia | Latvia | Lithuania |

|---|---|---|---|

| Taxation of Profits | 0% while profits are reinvested; 22% upon dividend distribution (full tax deferral). | 20% on distributed dividends. | 15% standard rate; 5% for certified startups and SMEs. |

| Tax Residency and Substance | Requires effective management and local accounting; e-Residency ≠ tax residency. | Requires minimal administrative presence. | Requires a local office and management. |

| OECD/EU Compliance | Full compliance (ATAD III and Unshell Directive). | Full. | Full. |

| Remote Management | 100% digital (incorporation, accounting, VAT OSS). | Partially digital. | Partially digital. |

| International Reputation | High (FinTech, transparency, digital governance). | Medium. | Medium. |

In Summary

Estonia leads with its simple and fully digital model—although real economic substance must be demonstrated—making it ideal for technology-driven businesses and e-commerce companies. Latvia offers stability and low operating costs, though with a more limited technological infrastructure.

Lithuania incentivizes startups through reduced tax rates and a strong focus on financial innovation, supported by its regulatory sandbox framework.

The Baltic model proves that fiscal efficiency does not depend on secrecy, but on digitalization and institutional trust.

Dubai: The Fiscal Bridge to Asia and the Middle East

Dubai remains a highly attractive jurisdiction, but it no longer operates under the same opacity standards of the past. Since the reform of the Economic Substance Regulations (ESR), every company must demonstrate physical presence, effective management, and local personnel to access tax benefits.

Legal–Tax Criteria (2025)

| Criterion | Dubai / UAE |

|---|---|

| Corporate Tax | 0% in free zones on qualified income; 9% under the general regime. |

| Economic Substance | Mandatory (office, resident director, local employees). |

| International Compliance | In the process of alignment with BEPS 2.0 and OECD review. |

| International Reputation | Mixed: strong financial prestige but ongoing transparency concerns. |

| Ease of Remote Management | High bureaucracy (licensing, notarization, and annual costs of around EUR 20,000–25,000). |

Dubai offers a strong strategic position for trade with Asia and Africa. However, it is not part of the European Union’s legal and tax framework, which means it cannot benefit from EU VAT systems or fiscal neutrality rules.

For this reason, while Dubai remains an excellent option for companies targeting markets in the Middle East, it is less suitable for businesses operating within the European Union.

Europe vs. the Middle East: Two Models, One Common Challenge

The comparison between the Baltic models and Dubai goes far beyond tax rates—it is about how each jurisdiction balances fiscal efficiency and regulatory compliance.

Strategic Factor Comparison

| Strategic Factor | Baltic Region (EU) | Dubai / UAE |

|---|---|---|

| Regulatory Framework | Transparent and harmonized with EU and OECD standards. | Autonomous, with increasingly strict substance regulations. |

| Market Access | Direct access to the EU Single Market. | Access to Asian and Middle Eastern markets. |

| Banking Reputation and Compliance | High, in line with EU AML/KYC standards. | In transition, subject to greater scrutiny. |

| Maintenance Costs | Moderate and scalable. | Higher, due to substance and licensing requirements. |

| Ideal Business Profile | Digital, technology-based, or EU-export-oriented companies. | Commercial, logistics, or investment-focused in Asia or Africa. |

Legal Conclusion: The Choice Depends on Market and Substance

The question is not which jurisdiction pays less tax, but rather which one allows you to maintain a legitimate, scalable, and market-compatible business model.

If your goal is to operate in Europe with low regulatory risk and high digital efficiency, the Baltic region offers the best balance between legitimacy and fiscal optimization.

If your focus lies in Asia, Africa, or the Middle East, Dubai remains a competitive alternative—as long as the new substance requirements are fully met.

In all cases, double taxation treaties, CFC regulations, and new OECD rules require specialized legal guidance to prevent potential tax contingencies.

Nieto Lawyers: Expert Guidance in International Structuring

At Nieto Lawyers, we advise international companies seeking to structure their operations based on fiscal efficiency and global compliance. Our team combines experience in foreign trade, customs law, tax planning, and international corporate structuring, following the standards set by the OECD, the European Union, and the FATF (GAFI).

The real advantage is not found in a tax haven, but in legal substance, solid reputation, and a well-designed fiscal strategy.

Looking to Structure Your Business Internationally?

At Nieto Lawyers, we analyze your business profile, target market, and the most suitable jurisdiction—whether in Europe, Dubai, the Caribbean, or Latin America—to design robust, compliant, and profitable structures.

patrimonios@nietolawyers.com | nietolawyers.com/inversion-extranjera

Discover our 2025 Guide: “Where to Incorporate Your International Company Without Tax Risks”

At Nieto Lawyers, we’ve created a free legal guide and toolkit to help you choose the right jurisdiction, optimize your taxes, and comply with the latest OECD and EU standards.

Download it for free and learn how to build a solid, reputable, and tax-efficient international structure.

WhatsApp

WhatsApp