In recent months, several global indicators ( including the well-known Big Mac Index) have suggested that Colombia appears “undervalued” when measured in U.S. dollars. While such indicators are not legal tools, they often reflect something investors understand intuitively: entry costs, currency dynamics, and timing matter.

For foreign companies evaluating Latin America, the question is not whether Colombia is “cheap.” The real question is whether the current macroeconomic and regulatory environment creates a strategic entry window and how to enter correctly.

An undervalued market does not automatically mean a low-risk market.

In fact, when currencies weaken and operating costs become comparatively lower in dollar terms, foreign investment tends to accelerate. When this happens, legal risk also increases for companies that move quickly without proper structuring.

What we are seeing in 2026

From a legal and transactional perspective, Colombia is currently in a phase characterized by:

- A relatively competitive cost environment for foreign companies

- A stable corporate and financial system within the region

- Increased interest from foreign investors in regulated sectors

- Heightened scrutiny from tax, regulatory, and supervisory authorities

- More complex compliance expectations for market entry

For sophisticated investors, this combination often signals opportunity but only when paired with disciplined legal planning.

Why currency and cost signals matter legally

When a country appears undervalued, foreign companies often accelerate entry decisions.

We frequently see companies:

- Entering through distributors without proper contractual control

- Incorporating entities without tax residency planning

- Importing products before regulatory registrations are complete

- Assuming compliance can be addressed later

- Underestimating enforcement risk

These are not commercial mistakes. They are structural legal mistakes and they can be costly.

In Colombia, enforcement in areas such as sanitary regulation, consumer protection, competition, data protection, and tax compliance has become more active and technically sophisticated. Authorities expect foreign companies to comply from day one, not after market validation.

Where we are seeing foreign investment interest

Over the past 18–24 months, we have advised companies from North America, Europe, the Middle East, and Asia in sectors including:

- Food and beverage

- Cosmetics and personal care

- Pharmaceuticals and medical devices

- Technology and digital services

- Distribution and logistics

- Manufacturing and supply chain operations

- Real estate and asset structuring

In many of these cases, the decision to enter Colombia was influenced by cost-to-market considerations combined with long-term regional strategy.

The most successful entries have one thing in common: they treat legal structuring as part of investment strategy not as a post-entry correction.

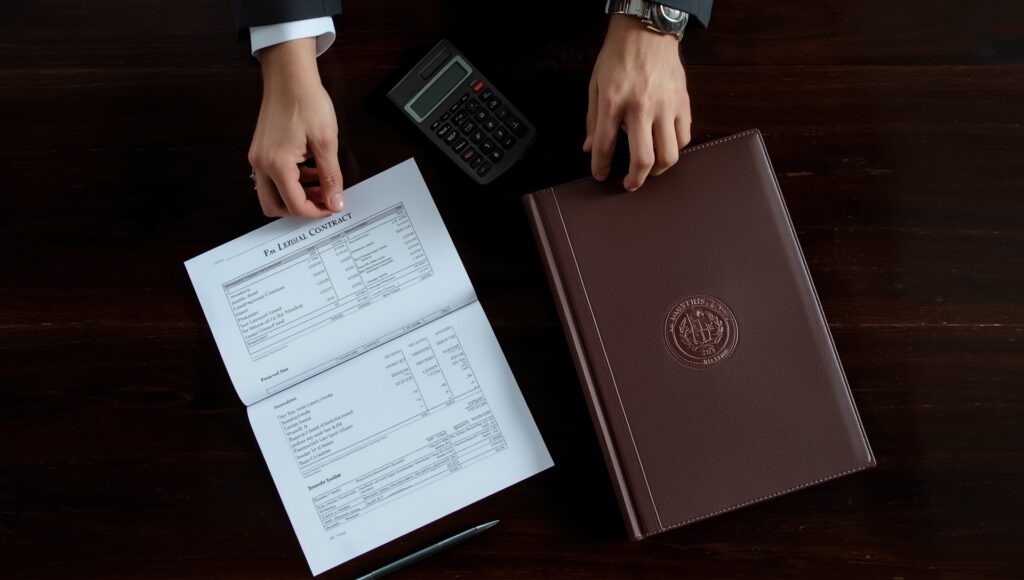

Common structural risks for foreign investors

From a legal standpoint, the most frequent issues we encounter include:

1. Improper corporate structuring

Choosing an entity type without analyzing tax exposure, liability allocation, or exit strategy.

2. Weak distribution and commercial contracts

Operating through local partners without enforceable protections or clear regulatory responsibilities.

3. Regulatory non-compliance at import stage

Assuming that sanitary registrations, labeling, or technical approvals can be completed after products arrive.

4. Tax exposure and permanent establishment risk

Operating commercially without understanding how Colombian tax authorities interpret presence and activity.

5. Intellectual property vulnerability

Entering the market before securing trademark and brand protection.

6. Misaligned timelines

Underestimating the time required for regulatory approvals or corporate structuring.

These risks do not necessarily stop investment but they significantly increase cost and complexity if not addressed early.

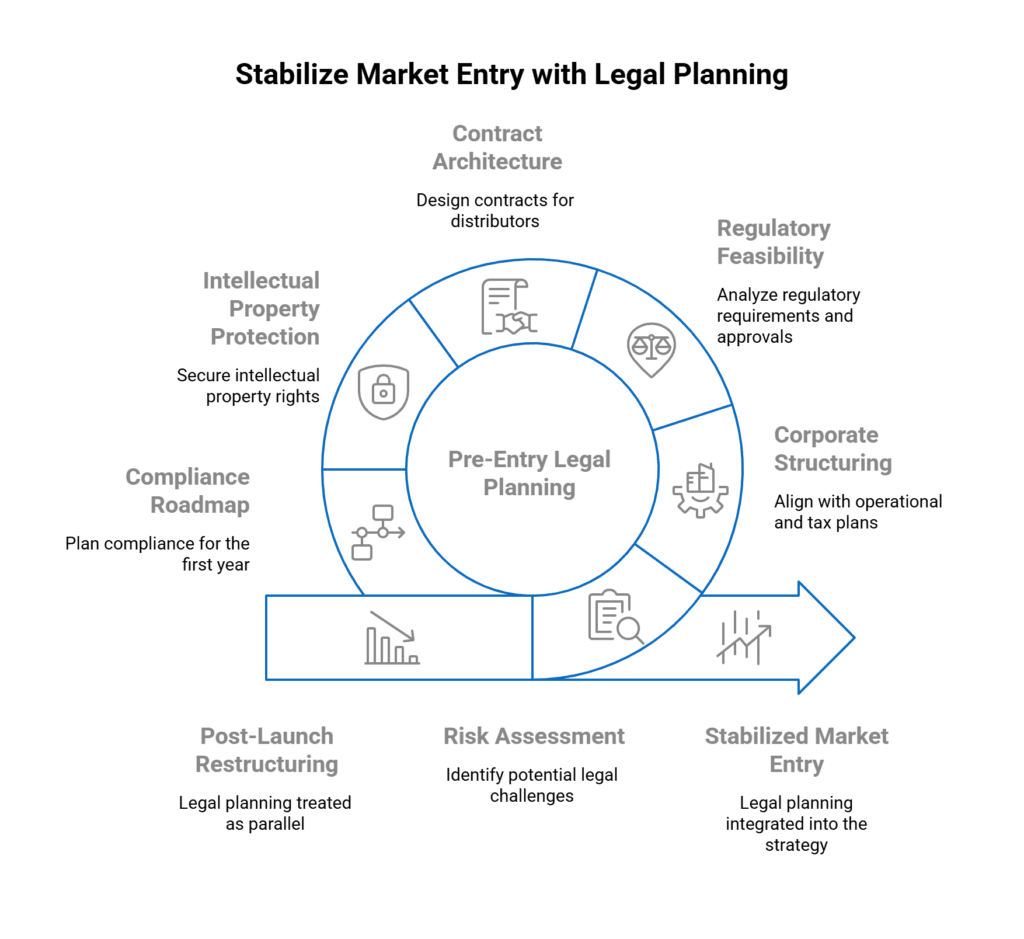

A disciplined entry strategy

Colombia remains one of the most relevant markets in Latin America for companies seeking regional expansion. Its size, geographic position, trade agreements, and sector diversity continue to attract foreign investors.

But entry strategy matters more than entry timing. An undervalued market can create a favorable cost environment. It does not reduce regulatory expectations.

For foreign companies considering Colombia in 2026, the key question is not simply whether to enter.It is how to enter in a way that protects capital, reputation, and long-term operations.

Our approach

At Nieto & Nieto Lawyers, we support foreign companies across the full investment cycle, including:

- Market entry strategy and risk assessment

- Corporate structuring and governance

- Regulatory and sanitary compliance

- Tax and cross-border considerations

- Commercial and distribution agreements

- Ongoing legal and compliance support

We work with companies entering Colombia for the first time, as well as those restructuring existing operations.

Final thought

Indicators such as the Big Mac Index may suggest that Colombia is currently “undervalued.”

From a legal perspective, what matters is whether investors enter with clarity, structure, and foresight.

Timing can create opportunity.

Structure preserves it.

If your organization is evaluating expansion into Colombia or reviewing its current legal structure in the country, we would be pleased to discuss how to approach entry in a disciplined and strategic manner.

WhatsApp

WhatsApp